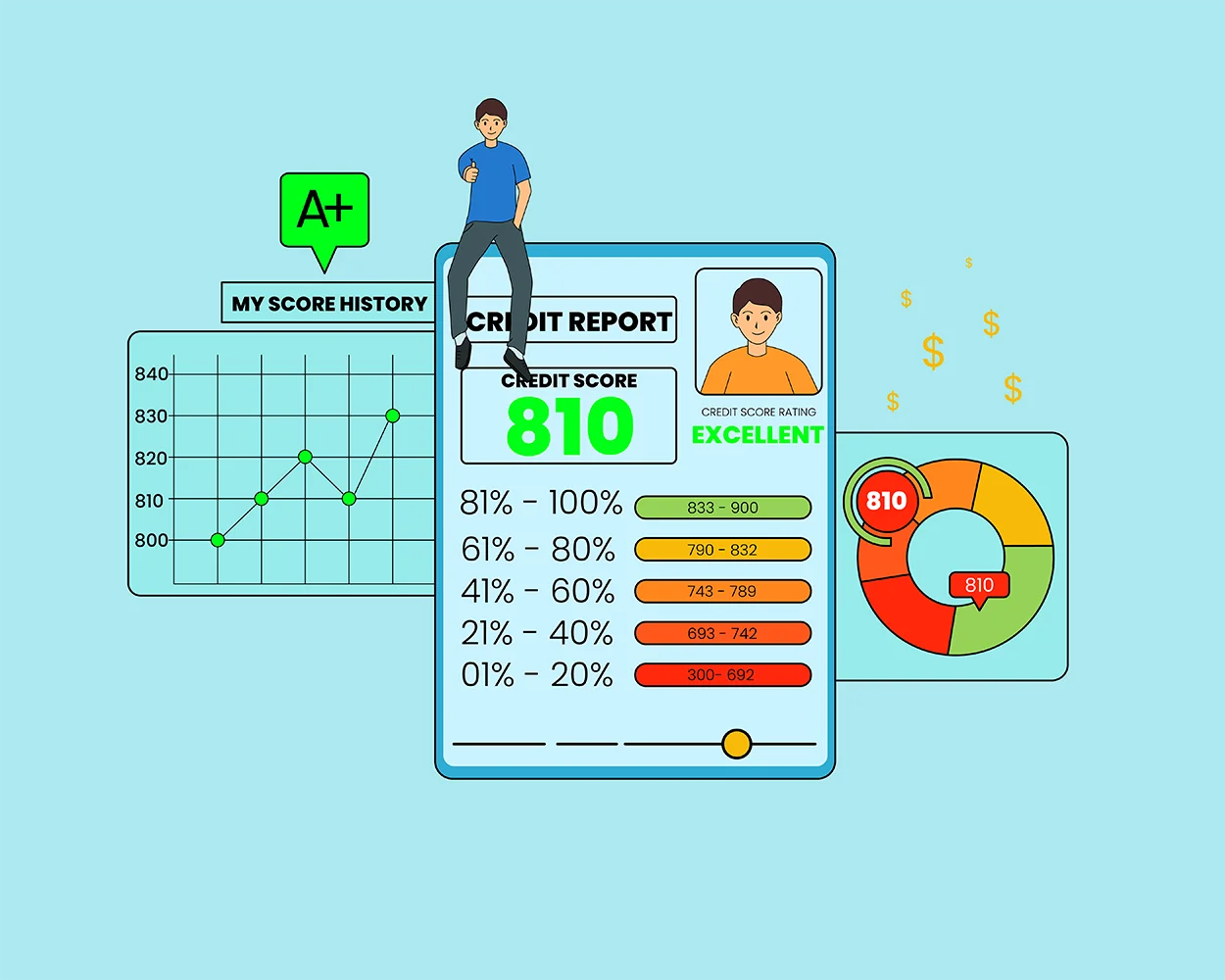

Build Credit in your Name

If you have delinquent credit and are married, you might want to build your credit in your name instead of using your spouse. Somebody has to have stability. Also if you are divorced and all the credit cards of credit information are in your spouse’s name you will need to reestablish your credit in your […]